- David Cumberbatch Published:

Consider utilizing new collateral of your home in order to consolidate expenses, done renos and more. You can influence the fresh new security in your home in order to borrow cash to pay for extreme expenditures or combine debts through getting an effective home guarantee loan.

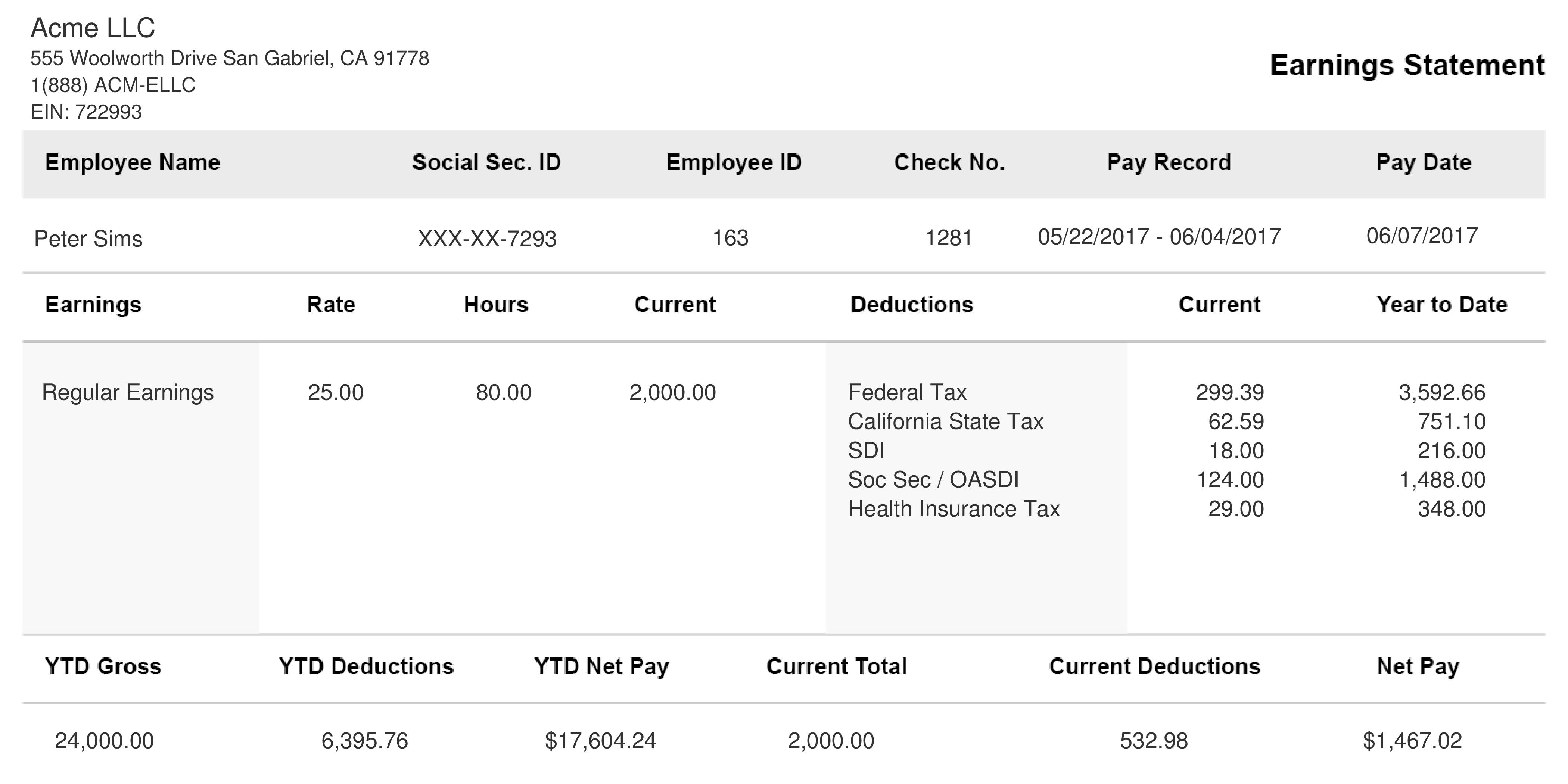

Equity of your property is actually calculated of the isolating the latest appraised well worth of your home by the harmony of mortgage. Using a house guarantee calculator may help regulate how far equity you really have.

Family Guarantee Finance calculator: Simply how much Perform We Qualify for?

This short article detail what house collateral loans are and you will the great benefits of getting all of them. We will including highly recommend an educated house collateral loan calculator so you’re able to explore.

The huge benefits and Advantages of Domestic Security Funds

Should you must finance large costs instance as family home improvements, expenses, large expenses, and other variety of major expenses, property equity mortgage is the right choice. Since your domestic may also secure a home equity financing, property guarantee mortgage may also be a lot more offered to qualify to possess than other style of loans.

Generally, home collateral money give fixed interest rates which can be have a tendency to straight down than those off unsecured credit. Inside an atmosphere in which rates is altering, a predetermined-rates financing shall be advantageous to possess simplifying budgeting since your month-to-month payment count continues to be the exact same into the mortgage years and certainly will perhaps not change.

Property security mortgage brings a lump sum amount to your. You might take advantage of this to meet large expenditures. To your decided-upon very long time, you repay the loan amount within the typical monthly payments, in addition to attract and you may principal. A house collateral loan have to be paid-in full regarding knowledge your offer your residence.

If you are using the loan particularly to help you remodel your residence, you may be qualified to receive an income tax deduction to your appeal paid off to the a home guarantee mortgage.

Household equity financing will be a good option if you’re a responsible borrower with a constant, reputable money. They allows you to favor just what costs they help coverage, particularly with an increase of considerable expenditures. You’ll be able to take advantage of all the way down rates and fees.

Consider the odds of a home Guarantee Line of credit (HELOC) with regards to the loan solutions. Domestic security finance and you can HELOCs can be interchanged. Which have a HELOC, you are approved getting a max amount borrowed and can merely withdraw everything undoubtedly need, the same as playing with a credit card.

One another funds give self-reliance with regards to the type of costs capable coverage. HELOCs generally have changeable interest levels, which means that your payments get raise otherwise fall off according to the changes in the pace list.

Family Equity Credit line (HELOC)

Household equity personal lines of credit (HELOCs) was revolving credit lines. HELOCs create borrowers to withdraw finance up to a predetermined restrict, generate money, and you will withdraw funds again.

A great HELOC allows the borrower to get the money just like the needed, while property collateral financing is one lump sum of cash. A great HELOC remains discover up until they ends. Depending on how the fresh debtor spends the financing range, minimal commission changes since the amount borrowed transform.

Home Collateral Lines of credit: Advantages and drawbacks

HELOCs become a max that you may be able to obtain, that’s according to the credit limit. HELOCs also provide the flexibility in order to borrow as much as the financing restriction or only expected.

The fresh new disadvantage away from HELOCs is dependant on the fact the interest rate can increase while the money. Therefore suspicion, good HELOC’s total cost will be difficult to imagine.

All things considered brand new outstanding balance can still be converted into a predetermined-speed house guarantee financing. Upon giving the fresh new financing, the financial institution have a tendency to utilize the loan’s proceeds to repay brand new HELOC, and thus closing brand new line of credit. New debtor manage pay back a house equity mortgage. The brand new borrower would need to go through the recognition strategy to transfer new HELOC balance towards a predetermined-rates collateral mortgage, and recognition isnt protected.

It may be difficult to acquire to possess large costs such highest bills, home improvements, otherwise medical payday loan Bon Secour costs. Taking right out a property guarantee personal line of credit is actually an option if you have collateral in your home.

Since your home is made use of since equity to possess home financing the rate would-be much lower than simply an unsecured loan someplace else. Your residence obtains the credit line, if you neglect to paying the go out, you might get rid of your residence.

In general, a good credit score renders qualifying having home guarantee loan money much easier. You can still find possibilities to acquire property equity distinctive line of borrowing from the bank that have an excellent bruised credit score and you will get.

Loan providers may accept the job to have a HELOC whether or not your credit rating was crappy because of factors other than the credit score.